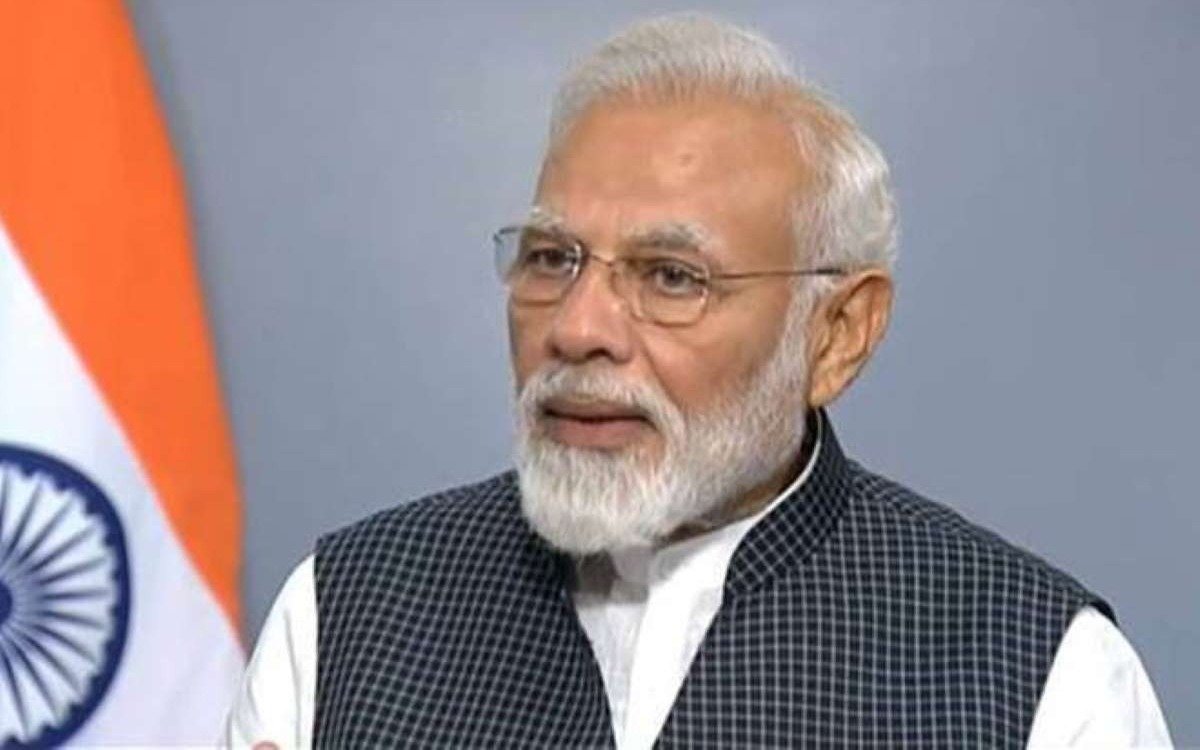

As part of the consultation process for the Union Budget 2026–2027, which is expected to be presented in Parliament on February 1, Prime Minister Narendra Modi attended talks with economists and sectoral specialists to gather recommendations on increasing economic growth and creating more jobs in the economy. Leading economists, professionals from a variety of fields, and senior NITI Aayog officials took part in the brainstorming session. Nirmala Sitharaman, the minister of finance, attended the meeting as well. According to an official, economists and sector experts were asked to discuss India’s economic status, development plan, and upcoming problems. The budgetary allocations that should be made across sectors in order to boost economic growth and employment were the main topic of discussion.

Ways to attract private investment in the economy were also mentioned in the recommendations. The discussion also focused on issues pertaining to the nation’s workforce’s skill development to fulfill industrial demands. In addition, the steps necessary to increase exports and bolster India’s competitiveness in international markets were discussed in light of the uncertainty surrounding the global economy brought on by the US trade dispute. In order to maintain the high growth rate and generate more jobs, the summit also emphasized the necessity for more investments in major infrastructure projects like ports, railroads, highways, and power projects.

Participants offered recommendations for the expansion of startups, MSMEs (Micro, Small, and Medium Enterprises), agriculture, and other sectors while keeping in mind the need to boost growth, create more jobs, and advance the Atmanirbhar Bharat (self-reliant India) goal. In order to guarantee growth with equity, discussions also centered on the actions required to further advance social and economic inclusion in the nation. Additionally, the source stated that discussions were held regarding the fiscal roadmap and how to maintain the fiscal deficit on a lowering glide path while ensuring the proper balance between the revenue to be collected through taxation and other measures and the allocations under various expenditure areas.